In the world of finance and investing, one concept that consistently arises is the concept of diversification in investment portfolios. Diversification is a strategy that aims to mitigate risk by spreading investments across different asset classes, industries, geographic regions, and other factors. The idea behind diversification is to avoid putting all eggs in one basket, as the old saying goes. This article will delve into the importance of diversification in investment portfolios, its benefits, and some key strategies to achieve a well-diversified portfolio.

The Importance of Diversification:

Diversification is a fundamental principle in investing, and it serves several important purposes. Firstly, it helps to reduce the overall risk of a portfolio. By spreading investments across different assets, the impact of a single investment’s poor performance is mitigated by the positive performance of other investments. This can help cushion the blow during market downturns and limit the potential for significant losses.

Secondly, diversification allows investors to participate in various market opportunities. Different asset classes perform differently under different market conditions. By diversifying, investors can potentially benefit from the growth of different sectors or industries, regardless of the overall market climate. For example, if one sector is experiencing a downturn, another sector may be flourishing, providing opportunities for gains.

Furthermore, diversification helps to balance risk and return. While some investments may offer higher returns, they often come with higher risks. By diversifying, investors can strike a balance between high-risk, high-return investments and low-risk, stable investments. This way, even if some investments underperform, the overall portfolio can still generate reasonable returns.

Strategies for Diversification

There are several strategies that investors can employ to achieve diversification in their portfolios. Here are some key approaches:

Asset Allocation

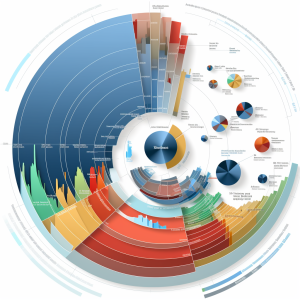

This strategy involves dividing investments across different asset classes, such as stocks, bonds, real estate, and commodities. The goal is to allocate funds in a way that balances risk and return based on the investor’s risk tolerance and investment objectives. The proportions allocated to each asset class may vary depending on the investor’s time horizon and market conditions.

Geographic Diversification

Investing in different geographic regions helps reduce exposure to country-specific risks and takes advantage of growth opportunities in various economies. Globalization has made it easier for investors to access international markets through mutual funds, exchange-traded funds (ETFs), and other investment vehicles.

Industry and Sector Diversification

Spreading investments across different industries and sectors can reduce the impact of a downturn in a particular industry. Different sectors perform differently based on economic conditions, regulatory changes, and technological advancements. By diversifying across sectors, investors can benefit from potential growth in multiple areas.

Individual Security Diversification

This approach involves investing in a wide range of individual securities within each asset class. For example, in the stock market, investors can choose to hold a diversified portfolio of stocks from various companies across different industries. This helps to reduce the risk associated with individual company performance and enhances the potential for consistent returns.

Diversification is a crucial concept in investment portfolios. It offers several benefits, including risk reduction, access to various market opportunities, and a balanced risk-return profile. By implementing strategies such as asset allocation, geographic diversification, industry and sector diversification, and individual security diversification, investors can build well-diversified portfolios that can weather market volatility and generate reasonable returns over the long term.

However, it is essential to note that diversification does not guarantee profits or protect against all potential risks. It is still essential to conduct thorough research, monitor investments regularly, and seek professional advice when needed. Investors should assess their risk tolerance, investment objectives, and time horizon to determine the most suitable diversification strategies for their portfolios. With careful planning and prudent decision-making, diversification can be a powerful tool in managing risk and maximizing the potential for investment success.